The success of global ecommerce in terms of multi-currency & multi-country situations relies on more than just traffic and availability of products. Localized experiences such as payment methods, currency, and cultural considerations are some aspects that need to be taken care of for developing trust in customers and driving loyalty and conversions.

What might happen if you choose to ignore these factors? Nothing more than a high rate of cart abandonment, increased fraud, and damage to brand identity. That’s all. Would you, as a CXO, accept these consequences? Definitely not.

Table of Contents:

- Introduction

- The Real Cost of a Broken Global Checkout Flow

- Payment Localization Is a Revenue Driver, Not Just a UX Choice

- Avoiding Hidden Operational Pitfalls

- Gateway vs. Orchestration Platforms: Picking the Right Tools

- Beyond Currency: Build a Localized Pricing Strategy

- What to Fix First: A 3-Step Action Plan

- Conclusion

Experiences linked with poor localized checkouts in the multi-currency ecommerce market also leads to expert prices. Customers expect that the renumerations of their preferred products will be displayed in their own local currency.

Also, customers prefer ecommerce sites that allow customers to use familiar payment methods. In the absence of these features/aspects, customers are likely to leave their ‘carts’ abandoned; this action leaves a negative impact on your brand.

The Real Cost of a Broken Global Checkout Flow

A broken global checkout flow in multi-currency, multi country ecommerce can result in noteworthy financial loss as well as negative impact towards customer loyalty. Here’s a detailed breakdown for these reasons:

-

Revenue Loss: Imagine the ecommerce site having a difficult checkout process. For example, it does not offer the preferred mode of payment or local currency rate. This results in customers neglecting their carts. Abandoned carts lead to loss of revenue. Also, incorrect ecommerce currency conversion strategies can result in a loss of sales and customer loyalty.

-

Increased support costs: A disruption in the checkout flow can result in an increased number of customer complaints and tickets, leading to an increase in support expenses to tackle those tickets & complaints. Also, any issue experienced during the checkout process increases the risk of chargebacks, taking considerable time to resolve.

-

Negative customer impact: Negative experiences spread word to mouth as well as online reviews, hampering the brand reputation. With every poor checkout experience, customers become dissatisfied, leaving very little chance for them to return.

If we talk about statistics, then around 65% of customers abandon shopping carts mostly during the checkout process due to the above-mentioned reasons. Again, 52% of customers do not proceed with the checkout process due to high shipping costs, mostly when shopping from international buyers. And around 38% of customers leave the site if they do not trust the payment process or feel anything suspicious/unsatisfactory during the checkout.

Ecommerce sites usually have an attractive and user-friendly checkout page, trying to leave a potential positive impression on the users while encouraging them to proceed with the process.

However, intricate checkout process/steps, unsupported payment methods, or multiple forms to fill can hamper the user experience, resulting in cart abandonment.

Payment Localization Is a Revenue Driver, Not Just a UX Choice

People usually consider payment localization with something that is simply related to UX choice. It is a crucial revenue driver for the multi-currency multi-country ecommerce business. By offering local payment methods, there is a significant impact of payment localization on conversions rates by building trust among customers and increasing loyalty. To understand the importance of payment localization for revenue growth, let’s look at the detailed breakdown for the reasons.

-

Decreased cart abandonment: Unfamiliar payment gateway/option is among the top ecommerce cart abandonment causes. Imagine adding all preferred products to the cart just to abandon it in frustration because your preferred payment method is not available. Payment localization eliminates such instances along with a smoother checkout.

-

Increased rate of conversions: When customers can use their preferred payment mode, they are more than happy to complete their purchase. Chances are that they might even turn into loyal customers.

-

Seamless transactions: With payment localization set, businesses can cater to more hiccup-less checkout experience for the users, encouraging brand loyalty and

-

Boosted brand loyalty: A positive checkout experience boosts customer satisfaction and businesses can earn their loyalty, increasing chances of retaining and even gaining new customers through a word-of-mouth strategy.

-

Access to unexplored markets: With localized payment methods, businesses can reach out to customers who do not have much access to global payment methods.

-

Building trust: Ecommerce sites that display accurate conversion in local currencies, along with offering local payment options

In essence, payment localization is not just about offering more than one payment option; it is about understanding the specific needs and preferences of your target audience in each market and offering them a seamless, trustworthy, and convenient payment experience.

Avoiding Hidden Operational Pitfalls

In multi-currency, multi-country e-commerce, understanding who pays for what, especially concerning taxes and shipping, is crucial for repeat purchases and overall business success.

Ignoring local tax laws can lead to significant financial penalties and legal issues, while the domino effect of even small operational errors can cast into major problems.

Detailed explanation on how multi-currency ecommerce works

-

Customer Selection: A customer browsing an online store selects their desired product and chooses their preferred currency from a list offered by the multi-country payment gateway.

-

Conversion at Checkout: The multi-currency payment gateway in ecommerce automatically converts the transaction amount into the customer’s selected currency using current exchange rates.

-

Payment Processing: The payment is processed in the chosen currency, and the funds are then settled with the business in their chosen base currency, often their local currency.

Discovering its multi-currency ecommerce impact businesses

-

Expanded Market Reach: Allows businesses to sell to customers in various countries without currency barriers.

-

Improved Customer Experience: Customers can pay in their local currency, leading to increased satisfaction and trust.

-

Reduced Transaction Fees: Minimizes currency conversion fees charged by banks, as the gateway handles the conversion.

-

Streamlined Operations: Simplifies international transactions by automating the currency conversion process.

-

Faster Payment Processing: Can expedite the payment process compared to traditional methods that might involve manual currency transactions.

-

Potential for Increased Sales: By removing currency barriers, businesses can attract more international customers, potentially boosting sales.

Recommended Reading:

Gateway vs. Orchestration Platforms: Picking the Right Tools

Selecting between a payment gateway and a payment orchestration platform is directly linked to one’s business requirements. There’s a simple difference between the two is very clear – payment gateways handle basic transaction processing whereas orchestration platforms provide high-end features such as smart routing, retry logic, and regional redundancy to enhance payments throughout various providers and locations.

So, in case your payment platform or system is restricting your growth and flexibility, it is time to switch to a cross-border payment orchestration platform.

Don’t just randomly pick and incorporate a multi-country ecommerce localization. You need to make sure that whichever platform/system you are choosing is well suited for your business. Let’s understand the key differences between the payment gateway and the payment orchestration platform to help you make the correct choice for the best payment gateway for global ecommerce.

Scalability and coverage: A payment gateway is perfect for businesses that operate in a small region or rather a single market. This gateway is ideal for handling localized transactions. However, to support global payment methods, there might be requirements for added integrations. On the other hand, payment orchestration platforms are designed for scalability. They can interact with more than one payment gateway and methods, facilitating businesses to offer assorted customer support across multiple regions/markets. For businesses who are targeting to expand on an international scale, the payment orchestration platform is an excellent choice.

Automation & operational efficiency: Payment gateways often require manual intervention for settlement and management of transactions, often resulting in inefficient output or result. Payment orchestration automates these tasks, removing any need for manual effort, thereby enhancing efficiency. Businesses are, in this way, able to keep resources free for other vital tasks while streamlining billing processes by automating retries for failed payments.

Compliance & security: Although payment gateways offer all the essential security features, many businesses often need extra features related to compliance when focusing on global operations. Payment orchestration platforms incorporate GDPR and other compliance standards to ensure adherence to global regulations while decreasing burden on business.

You need to ask yourself a couple of questions before deciding on the best payment localization solutions.

-

Is your business planning to expand into international markets?

-

Is your business revenue affected because of failed payments?

-

Is your business losing customer loyalty and trust because of payment issues?

-

Will payment gateway automation reduce the burden on your business?

-

Are you planning to support multi-currencies & methods of payment?

Beyond Currency: Build a Localized Pricing Strategy

For an effective localized pricing strategy in a multi-currency multi country e-commerce environment, it is important for businesses to step beyond the conventional means of simply translating prices according to different currencies. They should take into consideration factors such as competition, preferences of customers, taxes, shipping costs, and purchasing capacity for the target market.

Let’s take a more detailed look to have a better understanding of the ecommerce localization strategy.

Rather than implementing a flat rate of exchange, there are various factors such as shipping costs, regional taxes, consumer behavior, affordability, and competition that should be considered as well. Different regions would have different consumer perceptions of the price. Remember, a deal that’s good for one region might not be appreciated by another region. Hence, it is vital to consider customer perception of price.

If your business plans are to expand and enter the international market, go for implementing multi-currency pricing (MCP) as it would allow your business to put price tags on products & services in different foreign currencies while matching their home currency. Deploy IP-based geolocation for redirecting visitors to their country-specific product pages and prices according to the local currency.

There are several plugins and tools available that automatically adjust prices as per customer’s location, economic conditions, and other factors. While implementing these, ensure to give customers the option of switching between currencies for price comparison purposes.

Lastly, ensure that the payment gateway of your ecom website supports multi-currency transactions. This would not only give customers a brilliant experience but increase brand loyalty and trust. Also, don’t forget to maintain transparency related to any additional fees or taxes linked with currency conversion.

Dynamic pricing: Making relevant adjustments to meet demand, market conditions, or inflation

Dynamic pricing is the method of putting prices on products & services as per various factors such as season, market demand, and supply.

A great example of dynamic pricing is the HVAC units. These units cost more during summer but have a lesser price tag and other exciting offers during off-seasons.

In brick-and-mortar businesses, changing the in-store prices is quite difficult. In contrast to these, online businesses can easily modify their pricing.

Amazon, a reputed name in the ecommerce industry, uses dynamic pricing with its algorithm adjusting constantly and evaluating the prices displayed for online shoppers. Walmart is another similar organization that employs dynamic online pricing.

Psychological pricing by region

Moreover, there’s the psychological pricing by region strategy that needs to be incorporated into the dynamic pricing in the multi-currency multi-country ecommerce market. There are three simple yet effective strategies:

-

Price anchoring: This strategy involves presenting a higher price first so that the actual price seems to be reasonable. For example, a mobile phone with an actual price of 10k will usually have a higher price mentioned first so that customers will consider the 10k price tag to be reasonable.

-

Charm pricing: Here, prices often end with decimal values such as 45.99 or 799.99. This is to create a perception of a lower price tag among online shoppers.

-

Odd-Even pricing: This strategy involves putting a decimal price lower than the actual one to give customers a feeling of savings. For example, a product/service with an original price tag of $20 will have a $19.99 price.

Cultural buying behaviors that affect perceived value

We often ignore the cultural buying behaviors of customers that impact the dynamic pricing of multi-country ecommerce. Understanding these nuances is vital for every ecommerce business to optimize ecommerce payment localization strategies and achieve profit while establishing trust and loyalty among customers.

-

Risk Aversion: Some cultures may be more risk-averse and prefer fixed, predictable prices, while others are more comfortable with dynamic pricing that fluctuates based on demand.

-

Price Sensitivity: Cultural norms dictate how sensitive consumers are to price changes. Some cultures prioritize low prices above all else, while others are willing to pay a premium for quality, brand prestige, or unique experiences.

-

Perceived Fairness: What is considered a fair price varies across cultures. Some cultures may view dynamic pricing as a fair reflection of market conditions, while others may see it as price gouging or exploitation.

-

Brand Loyalty: Some cultures may exhibit strong brand loyalty, potentially making them more tolerant of price fluctuations if they perceive the brand as trustworthy.

-

Status and Social Influence: Certain cultures place high value on status symbols and social influence. Dynamic pricing strategies that cater to these values could be effective.

-

Collectivist vs. Individualist: Collectivist cultures, which emphasize community and social harmony, may react differently to dynamic pricing than individualist cultures that prioritize personal gain.

-

Time Sensitivity: Cultures that place a high value on time may be more willing to pay a premium for convenience and speed, while others may be more price sensitive.

-

Language and Communication: The way information is communicated about dynamic pricing can significantly impact its acceptance. Clear and transparent communication in the local language is essential.

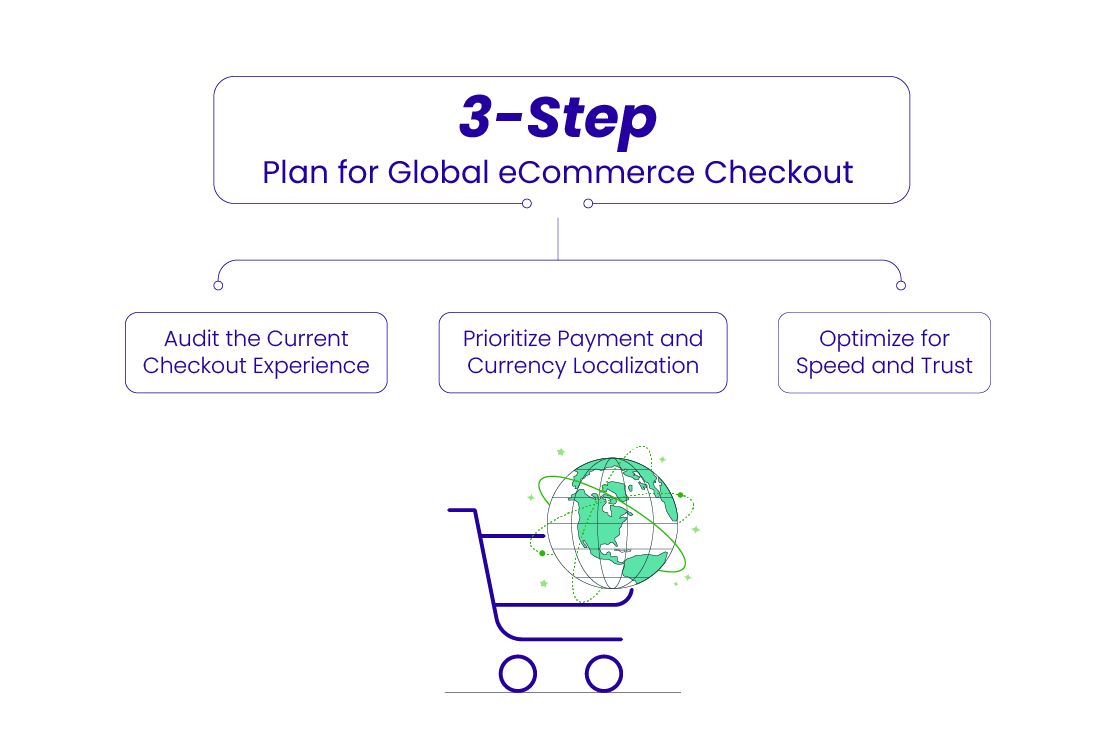

What to Fix First: A 3-Step Action Plan

To improve a multi-currency, multi-country eCommerce checkout experience, focus on these three steps: audit the current checkout, prioritize payment and currency localization, and optimize for speed and trust in the global ecommerce solutions.

Here’s a more detailed breakdown for the global ecommerce checkout action plain:

Audit the Current Checkout Experience:

-

Map the customer journey: Analyze each step of the checkout process, identifying potential friction points and areas for improvement.

-

Gather user feedback: Collect data through surveys, user testing, and analytics to understand user behavior and pain points during checkout.

-

Review technical issues: Check for slow loading times, broken links, and errors that might cause abandonment.

Prioritize Payment and Currency Localization:

-

Offer a wide range of payment options: Include popular local payment methods and ensure compatibility with various currencies.

-

Display prices in local currency: Show prices in the customer’s local currency to build trust and avoid confusion.

-

Consider dynamic currency conversion: Provide options for customers to see prices in their local currency or their preferred currency.

Prioritize Payment and Currency Localization:

-

Simplify the checkout flow: Reduce the number of steps and unnecessary fields to make the process faster and easier.

-

Implement trust signals: Display security badges, customer reviews, and guarantees to build confidence in the transaction.

-

Optimize mobile: Ensure optimize checkout process for multiple currencies so that it is mobile-friendly and functions seamlessly on all devices.

-

Reduce loading times: Optimize images, code, and server response times to minimize page load speed.

-

Provide clear and transparent communication: Offer clear shipping information, pricing details, and support options.

-

Allow guest checkout: Enable customers to purchase without creating an account to reduce friction.

-

A/B test different approaches: Experiment with different checkout designs, payment options, and copy to optimize conversions.

Conclusion

In multi-currency, multi-country eCommerce, the ecommerce payment gateway integration and localization process should be treated as a key conversion point, not a mere afterthought. This means optimizing the checkout experience to be seamless and user-friendly across different currencies and locations to maximize sales and reduce cart abandonment in international ecommerce.

Final takeaway for CXOs

CXOs – the ultimate decision makers or takers – need to understand that their businesses are nothing if they cannot earn and keep customers’ trust and loyalty. And to do so, they need to decrease the cart abandonment rate and implement strategies to enhance conversion rates. CXOs must remember that a smooth and seamless checkout experience is crucial for retaining customers in a global market.

Magento AI Integration: Transform Your eCommerce Store Into an AI-Driven Revenue Engine

Magento AI Integration: Transform Your eCommerce Store Into an AI-Driven Revenue Engine  Sync Magento Store with Other B2C Ecommerce Platforms: A Guide to Multichannel Integration

Sync Magento Store with Other B2C Ecommerce Platforms: A Guide to Multichannel Integration  MACH Architecture for Unified Global Multi-Store Ecommerce: The Future of Headless Commerce

MACH Architecture for Unified Global Multi-Store Ecommerce: The Future of Headless Commerce  Setting Up Global Ecommerce Stores Without Duplicating Infrastructure

Setting Up Global Ecommerce Stores Without Duplicating Infrastructure