This blog has been updated on - January 30, 2024

Breaking down data silos can narrow the challenges of accessing data stacked in your banking databases.

Many banks and other financial institutions incorporate big data for better decision-making and process agility. Having data kept in isolated repositories turns exhausting when companies need to gather information from disparate sources.

Data silos are probably the most common reason why banks opt for MuleSoft integration services to deal with such issues. The latter empowers users to segment fragmented data and shape interdepartmental collaboration across internal sources.

To make the most out of data analytics services, banking firms shall dissolve the issues with data silos first.

Using Salesforce-powered MuleSoft can boost the overall banking experience besides ensuring smooth access to siloed data. The blog will elaborate more on how MuleSoft data integration services can crush data silos in finance and why enterprises should opt for it.

Table of Contents:

- Data Silos Meaning: Intro and Definition

- Breaking Down Data Silos in Banking: What Does it Mean?

- Managing Data in Silos with MuleSoft Salesforce Integration

- MuleSoft Salesforce: Practices to MuleSoft Salesforce to Break Down Data Silos

- Break Down Data Silos: Why Rely on BluEnt for MuleSoft Data Integration & Management?

- FAQs

Data Silos Meaning: Intro and Definition

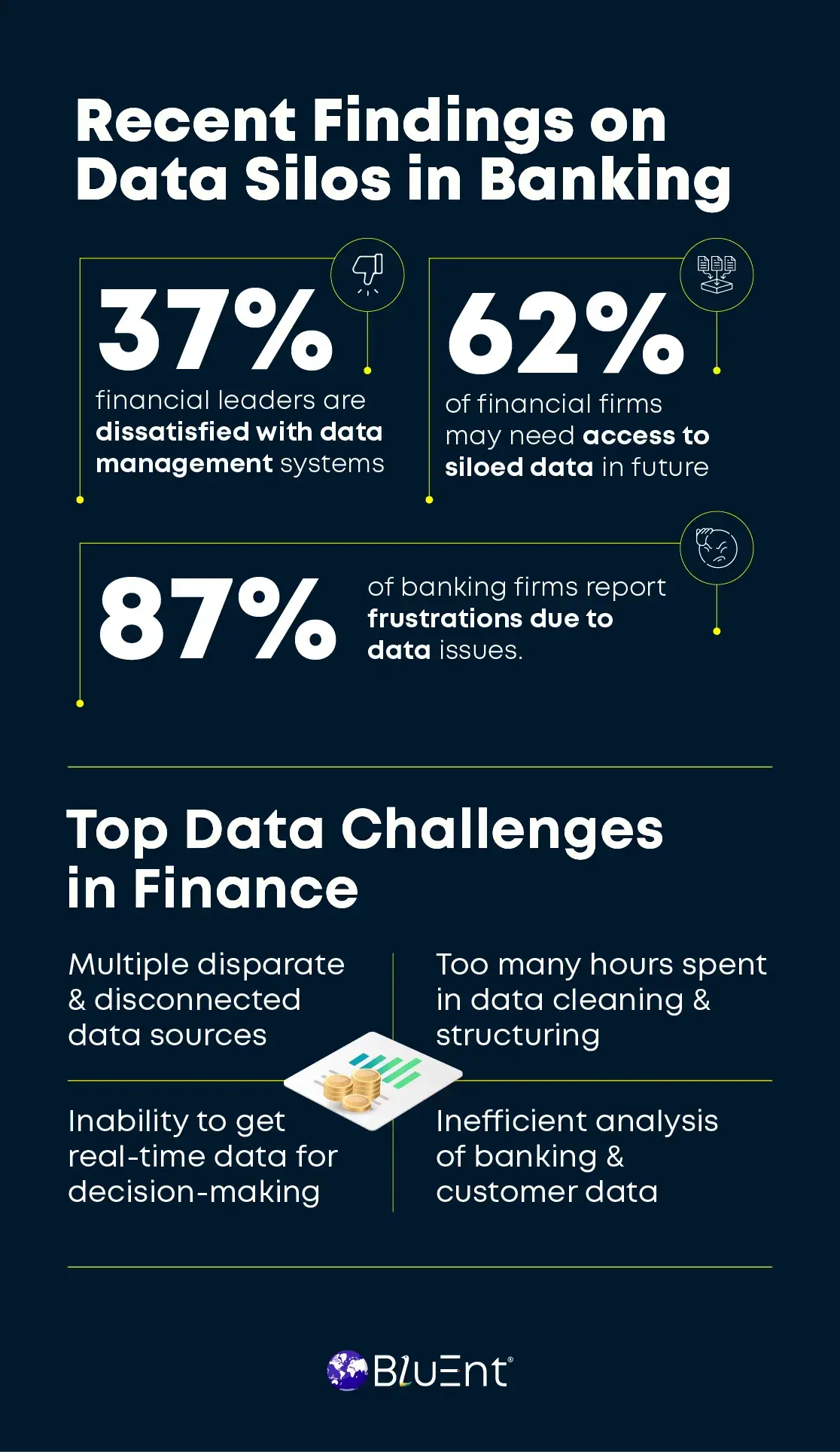

Over 89% of IT leaders believe data silos can slow the digital transformation cycle.

A data silo is a pack of information accessible to a specific department or teams employed within an organization.

Datasets are usually stored within large databases, systems, applications, programs, and locations with different files and folders. These are the repositories where data silos appear when it becomes difficult to integrate and share data with internal and external departments.

Banks relying on modern data engineering solutions need help to collect, generate, and inspect insights due to siloed data sources.

For example, a finance strategist uses big data insights to track customer behavior trends across distinct social media channels and analytical tools. In such a scenario, breaking down data silos becomes necessary if customer data is fragmented and disseminated in multiple sources.

The ideal approach to dealing with siloed data sources is prioritizing MuleSoft data integration and enterprise challenges.

Breaking Down Data Silos in Banking: What Does it Mean?

A recent report stated that around 39% of data-driven enterprises have over 50 data silos to handle.

Accessing and sharing data becomes more challenging when hierarchical data structures are complex and confined within multiple layers of management. That issue arises when data in silos pile up in isolated repositories and remain incompatible.

To break down data silos, hiring data integration experts using MuleSoft Salesforce is highly recommended.

Let's see how breaking down silos works in banking.

Managing Legacy Data

There is always a need to crush data in silos when outdated systems are used. It refers to the complexity of managing legacy data that eventually restricts banks from accessing, managing, and connecting it to other internal apps or software.

Dissolving Roadblocks in Data Exchange

Having siloed data sources to connect disparate banking software or apps can be problematic for database integration and maintenance experts.

That will also degrade the banking staff's operational efficiency and the quality of customer service.

For instance, eliminating data silos can empower bankers to provide faster and better customer support as data accessibility is more streamlined and secure.

Embracing MuleSoft API-led connectivity is a significant step to segregating and exchanging data on the cloud and on-premises apps. That is how users can eliminate siloed data sources.

Managing Data in Silos with MuleSoft Salesforce Integration

MuleSoft embraces API-led connectivity to streamline data sharing across company applications, tools, systems, and other internal platforms. However, it does a lot more than enterprise software app integration.

Banks deploying MuleSoft APIs can access, manage, and analyze internal data in silos. That eliminates the barriers to extracting complex and undefined data when requested by the customers.

With the power of Robotic Process Automation (RPA), MuleSoft Salesforce automates data extraction from siloed sources.

Here is how MuleSoft integration uses RPA to crush siloed data in financial segments:

Involves software robots to perform routine and repetitive tasks that reduce manual efforts in database maintenance.

End-to-end automation improves process efficiency, customer relationship management, and other banking operations. That eventually boosts customer satisfaction and agility in the internal workflow.

Centralizes multiple data sources and enterprise apps to give unified access to customer information.

Banks use various software or apps to store and manage data for loans, customer accounts, credit cards, insurance, etc. MuleSoft's RPA capabilities add value to its enterprise integration functionality by capturing siloed data from disparate sources on a centralized system.

MuleSoft Salesforce Integration: Practices to Break Down Data Silos

Breaking down data silos in banking drives efficiency in database design, development, and maintenance.

MuleSoft Anypoint and its pre-built connectors crush siloed data to enable seamless API integration. They ensure secure and smooth communication between internal teams, apps, and third parties.

Here are the prominent practices of implementing MuleSoft Salesforce in finance:

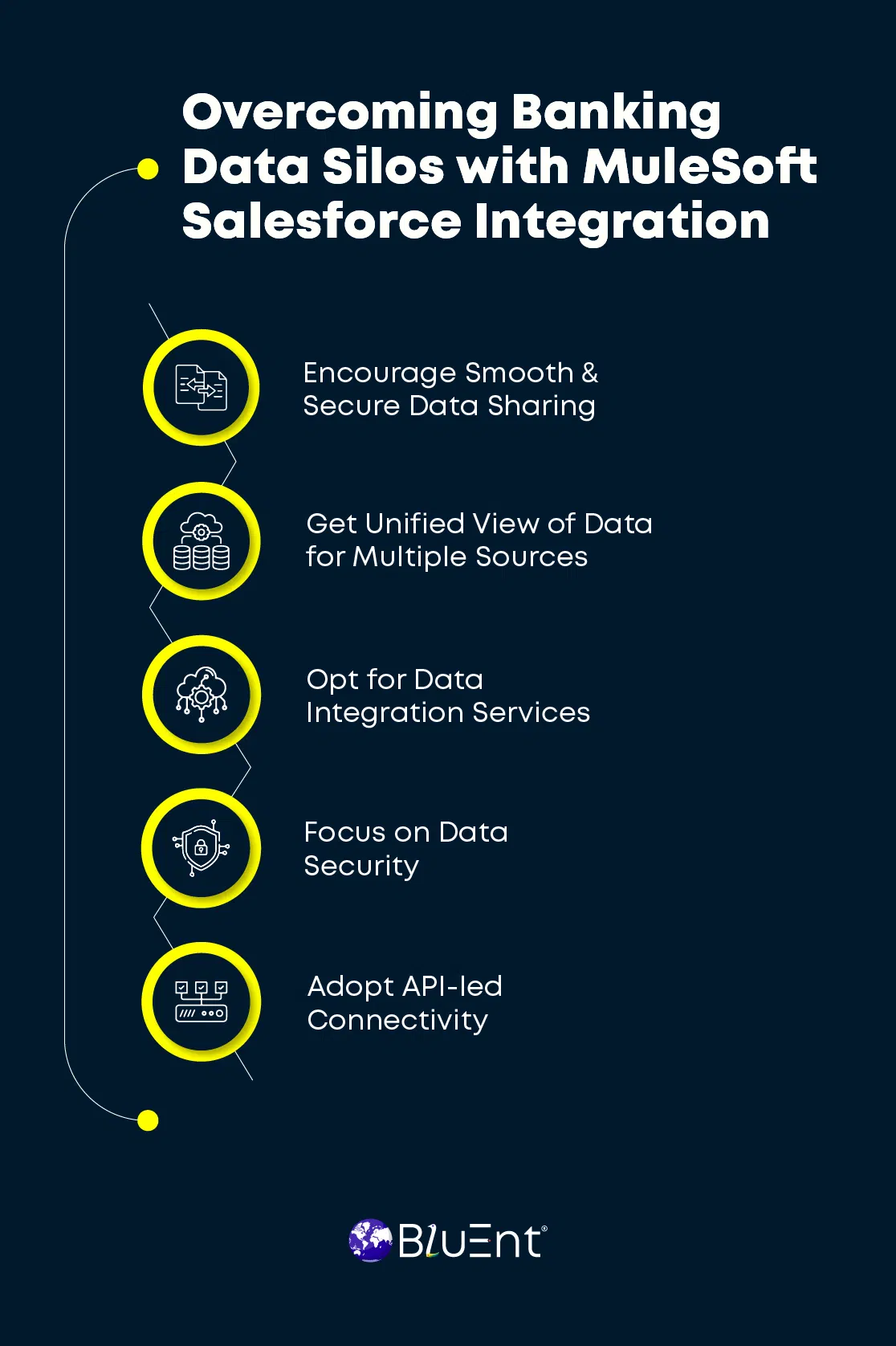

Encourage Smooth & Secure Data Sharing

Financial firms should prioritize the collaboration of internal departments, software, apps, and other system databases.

MuleSoft integration is a cost-effective way to automate data accessibility with these add-ons:

API-led connectivity and management: To build, deploy, secure, and manage APIs.

Integration: To connect data, applications, and systems across enterprises.

Automation: To accelerate and automate tasks, processes, and operations.

MuleSoft AI: To automate workflows with AI.

Educating teams about how enterprise integration can be used to connect siloed data sources is imperative.

Get a Unified View of Data from Multiple Sources

Conflicts and inconsistencies in data records have always been stressful for banking professionals. They mainly report issues when they have too many databases to monitor for financial data analytics.

Banks and financial enterprises can view all integrated data and insights holistically with MuleSoft Salesforce. That will establish a single source of trust among internal departments and improve transparency.

Opt for Data Integration Services

MuleSoft combines powerful enterprise integration tools to access, share, and manage data silos in banking. These tools enable users to integrate new databases into existing systems with automated extraction, segregation, and data transformation.

Besides breaking down data silos, MuleSoft cloud silos and integration go well with enterprise SaaS apps. That makes them more scalable, secure, cost-efficient, and maintainable.

Focus on Data Security

MuleSoft Salesforce complements financial risk analysis and management. Its robust technology and exclusive features ensure multi-layer security by exchanging siloed data.

Banks can adhere to strong protection policies, user authentication, and data privacy protocols besides breaking down data siloes. MuleSoft data integration makes it possible with enhanced API security, governance, and management.

Adopt API-led Connectivity

Enterprises can get real-time apps or software data by implementing API-led connectivity. They use robust and reusable APIs that are secure and compatible with distributed data in silos.

Data silos in large enterprises cost an average of 5 million due to low productivity and high expenses.

Check out some case studies for technology and business to discover how BluEnt helps businesses cope with these challenges.

Recommended Reading:

Break Down Data Silos: Why Rely on BluEnt for MuleSoft Data Integration & Management?

MuleSoft Salesforce is pioneering the concept of API-led connectivity with AI-powered data monitoring and security features.

From connecting enterprise apps to crushing data in siloes, MuleSoft integration eliminates the labors of manual efforts in managing, securing, and accessing data across the departments. Whether you're a banking professional or an independent finance company, hiring a MuleSoft-certified developer is worth an investment.

BluEnt is spearheading the domains of enterprise data integration with mastery in MuleSoft Salesforce. Our expertise involves database integration, design, development, migration, maintenance, and support with various enterprise-level service offerings.

We mark our global presence with over 20 years of experience in Business Consulting, CAD engineering, and Information Technology. Our technology portfolio features leading brands and enterprises we've assisted so far.

82% of top-performing enterprises use data visualization for strategic decision-making. It's time to join the race!

Get Data Visualization ServicesUnleash the power of data science to modernize your business data. Approach our data engineers for a detailed discussion.

Frequently Asked Questions

How does MuleSoft integration break down data siloes in the cloud?

The challenges of cloud silos are prevalent as more and more enterprises are migrating to the cloud environment. Breaking down data silos in the cloud is again necessary for enterprises using SaaS or other cloud-based systems to store data.

MuleSoft's CloudHub is a robust cloud integration platform that offers Integration Platform as a Service (iPaaS) to streamline data integration on the cloud. With CloudHub, enterprises struggling to manage cloud silos can quickly meet the challenges.

How can breaking down data in MuleSoft Salesforce boost customer experiences?

Breaking down siloed data sources using MuleSoft can improve the banking experience in these ways:

Connecting teams with a unified platform to view the entire customer or related data can make it easier to provide the best solutions to the customers.

Breaking down data silos can boost agility in processing data across teams and improve response times.

How is the MuleSoft eCommerce Integration Platform Mitigating Retail Challenges?

How is the MuleSoft eCommerce Integration Platform Mitigating Retail Challenges?  Why MuleSoft MFA (Multi-factor Authentication) is Crucial to Your Enterprise’s Data Security?

Why MuleSoft MFA (Multi-factor Authentication) is Crucial to Your Enterprise’s Data Security?  MuleSoft Architecture: Working Mechanism and Applications

MuleSoft Architecture: Working Mechanism and Applications  How Does MuleSoft API Integration Resolve the Challenges in Banking and Finance?

How Does MuleSoft API Integration Resolve the Challenges in Banking and Finance?